It is sometimes a heresy to question a political consensus but looking at the political furore over energy bills in the UK, one is tempted to ask: why have energy bills and energy companies become a major political issue in the UK, even though our bills are not, by comparison with other markets, especially high and the companies are not especially profitable?

Politicians have produced a raft of policies, most of which are derided by energy policy analysts, and yet, month after month, new, often radical, proposals emerge. Consequently, the notion that there is a ‘problem’ with energy prices is not challenged, reflecting a deeply held belief that crosses political parties.

By most objective measures, however, household energy costs in the UK are not high relative to our European neighbours. The UK has the cheapest residential gas prices in Western Europe and relatively cheap electricity as well, in large part because we have by far the lowest taxes on gas and electricity. Nor are price rises particularly notable across the European Union, and it is not entirely clear why the “Big 6” should be deemed particularly nefarious when no one seems to fret that the “Big 5” among mobile phone carriers is now the “Big 4”, with the merger of Orange and T-Mobile to become ‘EE’, even though their industry has larger profit margins.

We would like to take up this challenge: just how popular are these policy proposals and what factors can we identify as determining who supports such proposals?

YouGov-Cambridge Survey Results: Full of Sound and Fury

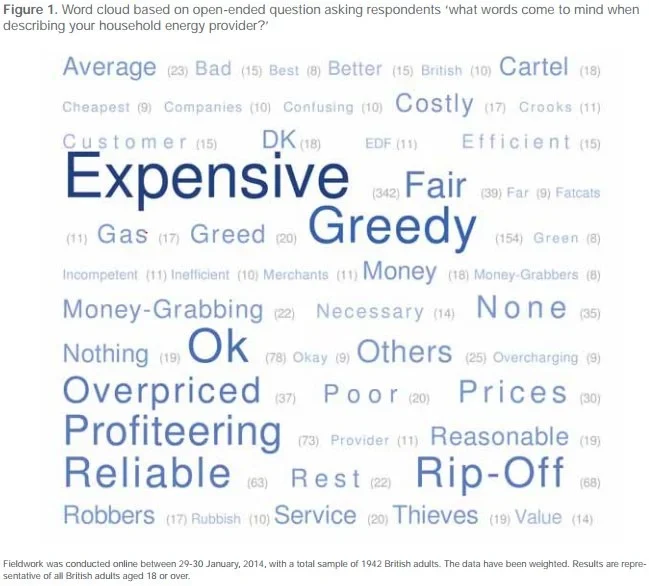

As part of research conducted for the YouGov-Cambridge Programme between 29-30 January 2014, a national representative sample of 1,942 British adults was asked a series of questions about support for various policy proposals. We first offered an open-ended question to elicit views on the energy suppliers by asking respondents ‘What words come to mind when describing your household energy provider?’ (see Figure 1)

By far the most common response was the description ‘expensive’, volunteered by 18% of respondents, but many of the next most common adjectives were far harsher terms, including ‘greedy’ (8%), ‘profiteering’ (4%), ‘rip-off’ (4%), ‘robbers’, ’crooks’ or ‘thieves’ (3%), as well as numerous references to ‘fat cats‘, ‘cartels’, ‘incompetence’, ‘confusion’ and several expletives.

A smaller number offered more charitable terms such as ‘ok’ (4%), ‘fair’ (2%), ‘reliable’ (3%) and ‘necessary’ (1%). Clearly, concerns over price, with a strong tinge of unfairness among many, pervaded the general sentiment with regard to the energy industry.

Similar to other recent surveys, we found energy prices to be one of the main concerns for the British public. Asked to name up to three of the ‘most important issues facing the country at this time’, almost two in five (39%) named ‘energy prices’ as one of the top issues, which was in third place behind only ‘the economy’ (59%) and ‘immigration and asylum’ (49%), and far ahead of a range of typically high-profile policy issues including healthcare (25%), education (14%), Europe (14%), environment (12%) and crime (10%).

Energy prices were seen as particularly important among certain groups, notably including almost half of all respondents aged 60 and over (49%), and Labour voters (46%). There were also cleavages by region, with far greater concerns in the North of England (45%), for example, than in London (29%). Asked to narrow down their choice to the single most important issue facing the UK, energy prices remained third although only 8% cited it as the top issue, far behind the economy (39%) and immigration and asylum (28%).

It is still striking though that 13% of Labour voters (compared to less than 5% for voters of other major parties) and 12% of older voters described energy prices as the single most important issue facing the country. Asked on a scale of 1-5 whether they had been following the debate over household energy prices, where 1 was ‘not at all’ and 5 was ‘very closely’, only 10% admitted to following the debate ‘not at all’ whereas almost half (46%) rated their attention level as a 4 or 5.

Understanding bills and tariffs

We also asked a number of questions with regard to energy bills, including whether people found it difficult to understand their energy bills and energy tariffs.

Just over a third (35%) found it easy to understand their bills, of which 8% described it as ‘very easy’ and one third (33%) described it as ‘difficult’, including 11% who described it as ‘very difficult’. When asked about energy tariffs though, that number declined so that less than a quarter (23%) found it easy (only 4% ‘very easy’) compared with almost half (47%) who found it difficult (including 18% ‘very difficult’).

There was some difference between political parties in judging their bills, whereby half of UKIP respondents (50%) and more than a third of Labour respondents (36%) found it difficult to understand their energy bills compared to roughly one quarter of Conservative (28%) and Liberal Democrat (25%) respondents. The ease with which respondents understood their bills or tariffs did not appear to be influenced by many other factors that one might have expected. For example, education had little impact – those with few qualifications were just as likely to express difficulty understanding energy tariffs as those with graduate degrees.

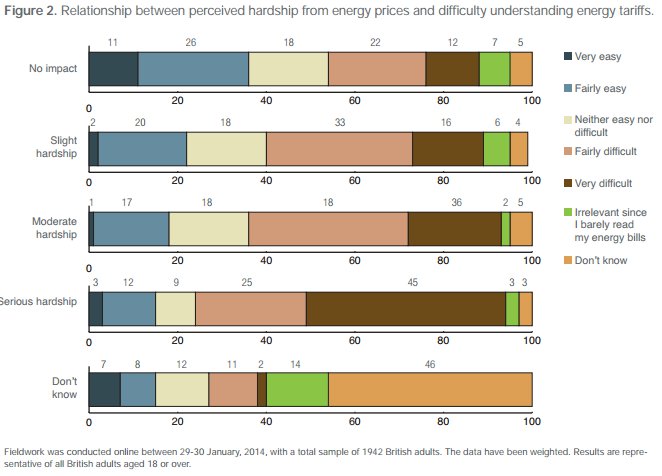

The most striking source of difference in understanding energy tariffs was related to those who felt that energy prices imposed a hardship when we asked ‘what impact, if any, are energy prices having on your household financial situation?’

Only a third (34%) of those who felt that energy prices imposed no impact on their household finances found energy tariffs difficult to understand, compared to almost half (49%) of those who felt energy prices imposed a slight hardship, 57% who found prices posed a moderate hardship and 70% for those feeling a serious hardship. The greater the perceived hardship the larger the share who found energy tariffs very difficult to understand. Indeed, almost half (45%) of those who perceived energy prices to pose a serious hardship found energy tariffs to be very difficult compared to only 12% of those who felt no impact.

Given the sense that many find bills and tariffs difficult to understand, we therefore asked whether they would support or oppose the energy regulator making the energy companies simplify their tariffs, which was greeted with almost unanimous support (84% overall including 88% of Conservative supporters and 87% of Labour supporters), with negligible (2%) opposition.

When we introduce any hint of a trade-off, however, support plummets. If simpler tariffs meant tariffs might be slightly higher or meant fewer discounts were available, then support dropped to just over one-quarter (28%) and opposition soared (to 40%). Similar to the non-trade off version of the question, there was only minimal variation in terms of political party or other demographic variables.

Perceived impact of energy initiatives on bills

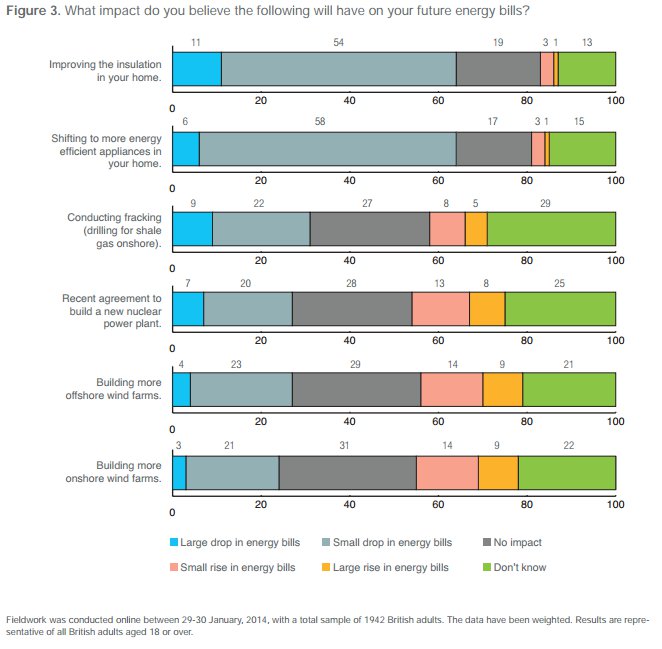

We further looked at the perceived impact of different energy supply investments on energy bills. As a point of reference, the recent agreement for the first new nuclear power plant in a generation at Hinckley Point C agreed to pay over £90/MWh or roughly double the current power price of approximately £50/MWh. The cost of offshore wind is even higher, over £150/MWh, or roughly triple the current power price. Onshore wind is lower, roughly comparable to the price for nuclear power. It is therefore quite remarkable that less than 10% of

respondents believe that nuclear, onshore wind or even offshore wind will result in a large rise in energy bills in the future. Moreover, more people believe that future energy bills will be reduced as a result of building more nuclear or wind power than those who believe that prices will rise.

We compared these views on low-carbon technologies to perceptions of the impact of drilling for shale gas (fracking), which has been touted by advocates (including some in government) for its potential to reduce energy prices as well as to demand - side measures that would clearly reduce household energy bills. Although over 60% believe that more energy efficient appliances and additional home insulation will reduce energy bills (which itself is actually quite low), it is notable that there is little expectation that fracking will reduce energy bills and the perceived impact on energy bills is only marginally better than the view of nuclear power.

Attitudes to policy proposals

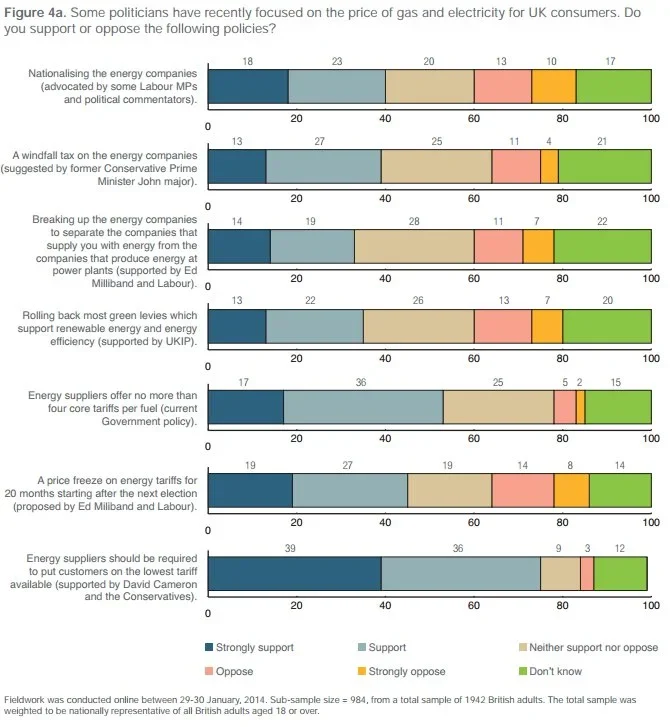

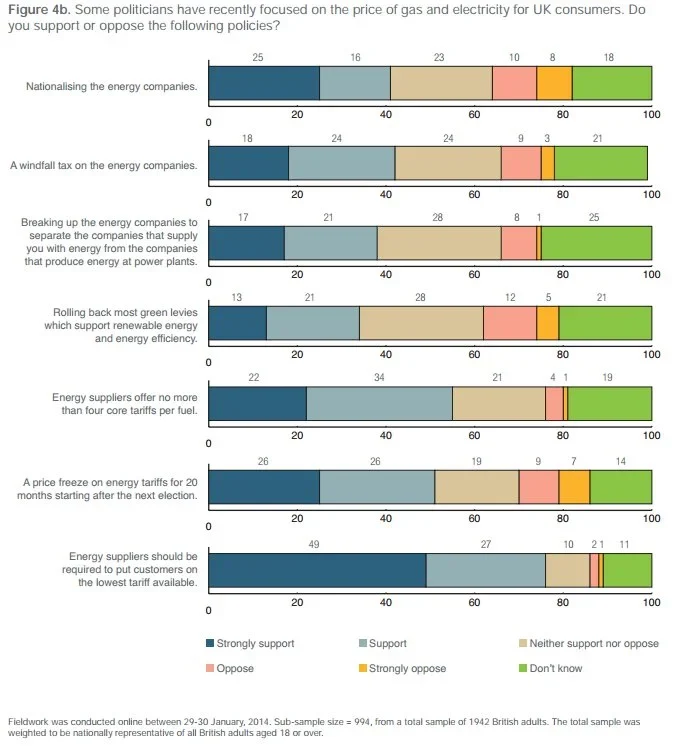

We then asked about seven different widely discussed policies related to energy prices: (i) requiring customers to be placed on the lowest tariff available; (ii) a price freeze on energy tariffs for 20 months starting after the next election; (iii) breaking up the energy companies; (iv) not allowing energy companies to offer more than four core tariffs; (v) rolling back green levies; (vi) a windfall tax; and (vii) nationalising the energy companies.

For half the sample (n=994) we simply listed the policy and for the other half of the sample (n=984) we associated the policy with the relevant advocate (e.g., price freeze with Ed Miliband and Labour, windfall tax with Sir John Major, etc).

It is interesting that, by far, the most popular policy both in terms of overall support and those who voice strong support is the Cameron policy ‘requiring’ all consumers be put on the lowest tariff available, showing negligible opposition.

Next most popular is the current government policy to limit energy companies to four core tariffs followed closely by the 20-month price freeze policy (each policy roughly supported by half of respondents where one-fifth express strong support).

Opposition to the price freeze policy is much higher however, particularly when it is associated with Labour. The windfall tax and nationalisation proposals were next most popular (attracting some 40% support) followed by the proposals to roll back green levies and to break up the energy companies (supported by roughly one-third).

All these proposals do attract some opposition though and the overall level of opposition increases for each proposal when it is associated with its proponent. Unsurprisingly, supporters of other parties become more opposed to a policy when it is associated with a political rival.

At a national level, support for these policies appears to be quite stable, whether or not they are associated with the political party or politician advocating the policy, but that apparent stability hides a shift when we look into the data by party.

For example, when simply presented as a policy to put all households on the lowest tariff, 57% of Labour supporters express strong support but when associated with David Cameron that strong support drops to 35% (importantly though the main shift here among Labour voters is from ‘strong support’ to ‘support’, which helps explain why this policy remains the clear favourite). Overall support for a price freeze drops among Conservatives from 38% to 25% when that policy is associated with Ed Miliband and Labour, and Conservative support for breaking up energy companies is halved from 34% to 17% when associated with its Labour proponent.

There is also a strong preference among Labour voters for nationalisation proposals (supported by over half of Labour respondents) and the price freeze (supported by two-thirds even when not linked to Labour), whereas even when not associated with a political party, only 29% of Conservatives support nationalisation and 38% support a price freeze.

Obviously, given its visibility, many Conservative voters will associate the price freeze with Labour, whether or not we mention it in the question.

For a windfall tax, fully half of Labour supporters back the proposal (even when linked to John Major) whereas only 36% of Conservatives do. By contrast, half of Conservatives support rolling back green levies (when not associated with UKIP) whereas only 30% of Labour voters support the proposal. The proposed reduction in green levies is the most popular among UKIP voters and least popular among Lib Dem voters.

The reason for the high popularity of the proposal that requires energy suppliers to put customers on the lowest tariff is that its support cuts across party lines and garners support across the political spectrum, whereas the other proposals tend to be most attractive only to certain factions.

For the split sample where we did not ascribe the source of the proposal, 45% of those facing serious hardship expressed strong support for a price freeze compared to 29% of those claiming moderate hardship, 24% citing slight hardship and 19% who state energy bills have had no impact on household finances. Opposition to a price freeze was virtually non-existent among those hardest hit whereas over one-quarter (26%) of those who claimed that prices had no impact on their finances were opposed to the price freeze.

Perception of energy bill components.

We also asked respondents what components make up their energy bill, i.e., out of every £100 spent, what fraction goes to (i) the costs of generating energy; (ii) the cost of government schemes (to support low-carbon energy, low-income customers); (iii) profits for the company; (iv) delivering energy to the home; customer services; and (v) taxes.

In spite of the fact that energy companies would point to retail profits of less than 5%, the average profit was believed to be 23%, with only 16% of respondents believing that profits accounted for less than 10% of the bill.

Not surprisingly, perceived profits were correlated with the level of support for a number of policies, most notably with regard to a windfall tax and nationalising the energy industry. On average, those expressing strong support for a windfall tax believed that 30% of the energy bill went to corporate profits compared to strong opponents of the windfall tax who believed that the figure was half that (15%). Similarly, strong supporters of nationalising the energy industry believed, on average, that profits accounted for 26% of household energy bills compared to strong opponents who estimated that profits were only 18%.

Conclusion

It is good to be sceptical of all manner of populist policies in the run up to an election on grounds that such policies often prove unworkable, are abandoned once in government or because, when implemented, they produce unintended (though easily foreseen) consequences.

Rather than either dismiss these policies or accept the claims that such proposals are resonating with voters, we have tested the levels of support for the main proposals to address rising energy prices.

All the proposals presented, including quite radical ones such as nationalising the energy industry or abandoning green levies, attract considerable support (a minimum of 30%-40%). But even in the absence of being associated with rival political parties, a number of proposals (rolling back green levies, nationalization and the price freeze) also engender sizable opposition (15-20%).

Once associated with a proponent, support from the proposer’s side strengthens while support from political opponents weakens. In the real world, we do not have access to ‘clean’ apolitical proposals, so unless a political consensus develops around a particular policy (as there was, for example, at the time of the Climate Change Act) then it is inevitable that the results where policies are associated with their proponent (Figure 5a) are a more accurate reflection of the existing political debate.

Many of the factors that one might have expected to help explain support for specific proposals such as ease of understanding energy tariffs or having ever switched suppliers appear to have little impact on level of support for policies such as the price freeze (i.e., those who have switched in the past year or fi ve years are no more likely to support a price freeze than those who have never switched).

The most important non-political determinant of support for policies such as the proposed 20-month price freeze is perceived hardship imposed by energy bills. Perceived profi ts of the energy companies are also strongly related to proposals such as the windfall tax or nationalizing the energy industry.

Nevertheless, political party appears to play the critical role in assessing support for various proposals and that effect is significantly strengthened when a policy proposal is associated with its political proponent.